Calculate rmd for 2022

Then divide your balance by the distribution period. RMD or Required Minimum Distributions is simply the minimum amount from your tax-deferred retirement account that.

Required Minimum Distributions For Retirement Morgan Stanley

Distribute using Table I.

. Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service. Save for Retirement by Accessing Fidelitys Range of Investment Options. 100000 divided by 256 is 390625 which is the.

Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. Ad Discover New More Personalized Approach To Helping You Plan Your Retirement With Merrill. As part of the bipartisan COVID-19 stimulus bill Congress suspended required minimum distributions for 401k and IRA plans for 2020.

FMV as of Dec. 2022 Retirement RMD Calculator Important. Paul must receive his 2022 required minimum distribution by December 31 2022 based on his 2021 year-end balance.

Pauls first RMD is due by April 1 2022 based on his 2020 year-end balance. Lets say you have a combined 100000 in your tax-deferred retirement accounts. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an account each year to avoid IRS penalties. What If You Dont Take an RMD in Year of Death. Ad Register and Subscribe Now to work on IRS IRA Required Minimum Distribution Worksheet.

Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs. April 1 2022. You will need to calculate your RMD each year because it is based on your current age and account balances at the prior year-end.

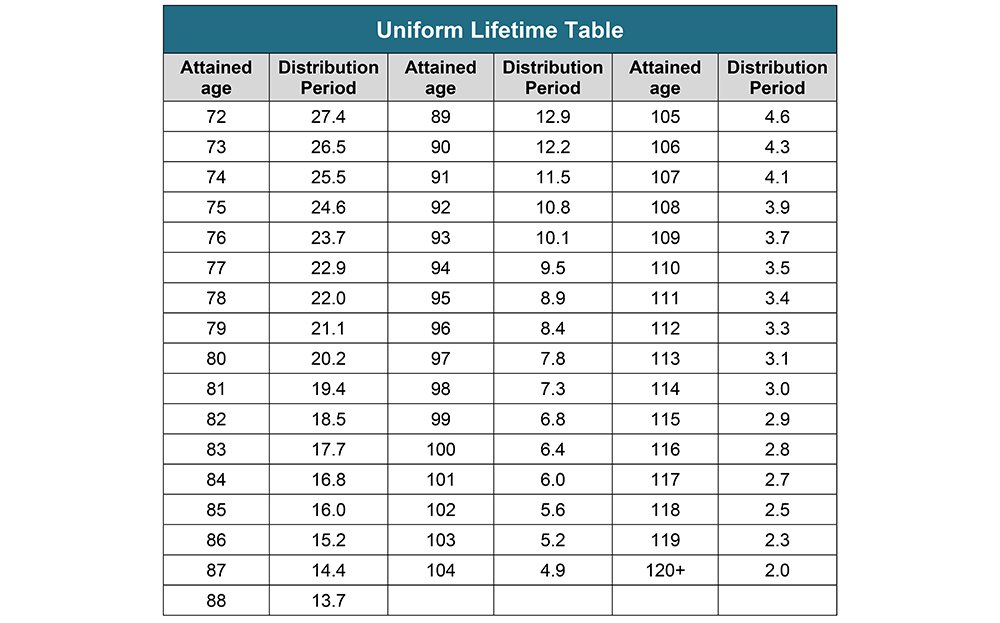

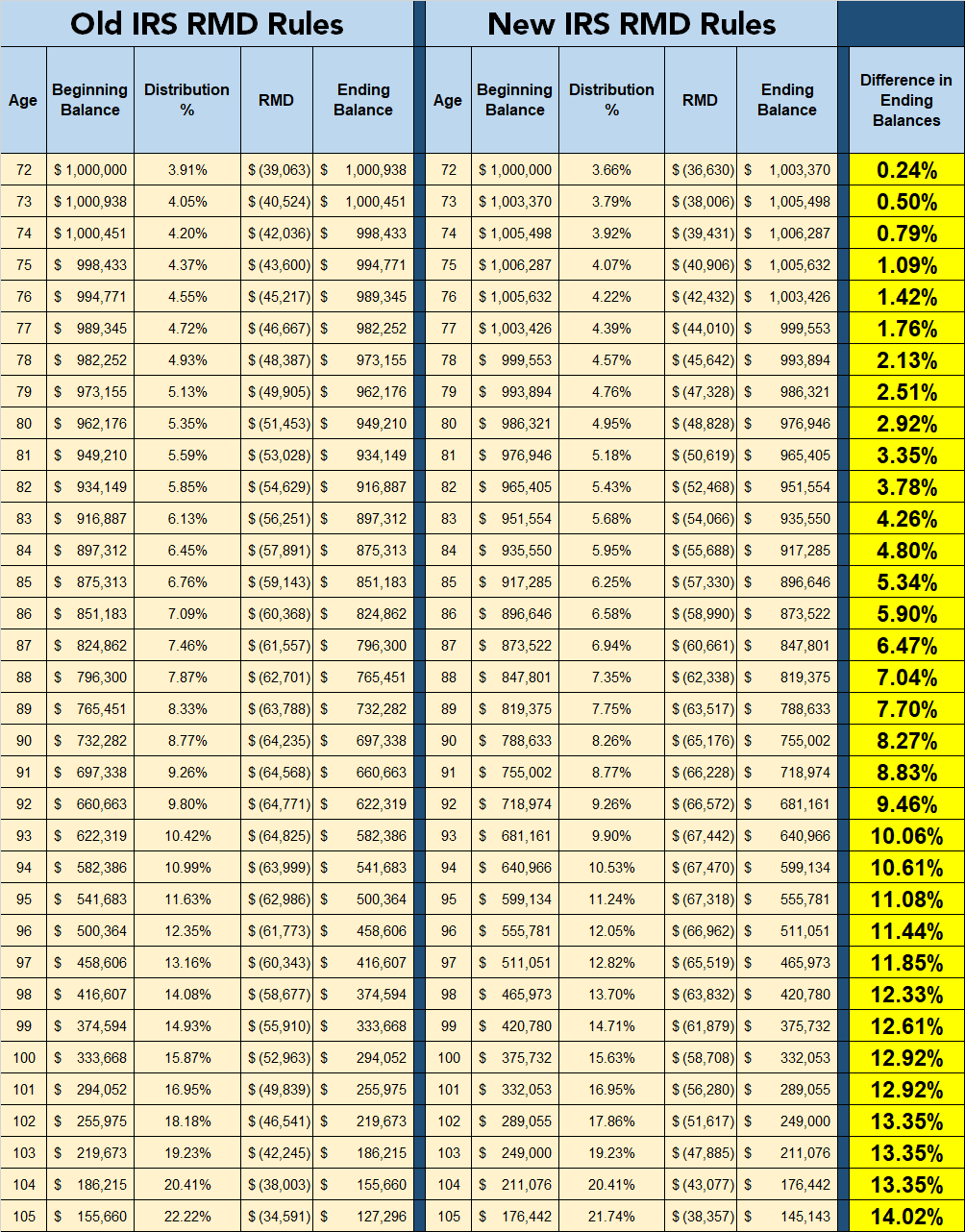

How is my RMD calculated. The required amount is calculated by dividing the retirement account balance as of December 31 of the previous year by a life expectancy factor. Save for Retirement by Accessing Fidelitys Range of Investment Options.

Since Paul had not reached age 70½ before 2020 his first RMD is due for 2021 the year he turns 72. The SECURE Act of 2019 raised the age for taking RMDs from 70 ½ to 72 for. Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death.

Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service. If you are the original account owner your RMD is calculated by dividing prior year-end account balances by a life. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year.

Ad Use This Calculator to Determine Your Required Minimum Distribution. 0 Your life expectancy factor is taken from the IRS. Spouse date of birth optional Calculate.

Our Resources Can Help You Decide Between Taxable Vs. Calculate your required minimum distributions RMDs The RMD calculator makes it easy to determine your required minimum distribution from a Traditional IRA to avoid penalties and. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

The IRS released final regulations effective January 1. First the account owner determines the account balance as of December 31 of the year before. All this site does is calculate Required Minimum Distributions.

Determine beneficiarys age at year-end following year of owners. Owner date of birth. Take Advantage of Potential Tax Benefits When You Open a TD Ameritrade IRA Today.

Account balance as of December 31 2021 7000000 Life expectancy factor. Ad Refine Your Retirement Strategy with Innovative Tools and Calculators. A simple calculation determines the amount of the RMD.

What Is a Required Minimum Distribution RMD. She uses the post-2021 Uniform Lifetime Table to. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. The required amount as a. Calculating your RMD is relatively easy.

An RMD is the minimum amount of money you must withdraw from a tax-deferred retirement plan and pay ordinary income. To calculate your required minimum. To calculate your required minimum distribution simply divide the year-end value of your IRA or retirement account by the distribution period value that matches your age on.

The IRS requires you to start taking RMDs at 72. Use this calculator to determine your required minimum distributions RMD from a traditional IRA. Herein How to calculate RMD for 2022.

The deadline for taking RMDs in the year of death is December 31 st of the year in which the original account owner passes.

Your Search For The New Life Expectancy Tables Is Over Ascensus

Rmd Table Rules Requirements By Account Type

Good News For Retirees Rmd Formula Changing For First Time In Decades In 2022 Budget Calculator Financial Decisions Money Saving Tips

Required Minimum Distributions Update 2021 Fcmm Benefits Retirement

Rmd Tables

Where Are Those New Rmd Tables For 2022

Rmd Calculator Required Minimum Distributions Calculator

New Guidelines For Your Required Minimum Distributions Rmd Coming In 2022 Paul R Ried Financial Group Llc

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

Required Minimum Distribution Rules Sensible Money

Your Search For The New Life Expectancy Tables Is Over Ascensus

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management

Irs Change Will Decrease Rmds Beginning In 2022 Level Financial Advisors

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Where Are Those New Rmd Tables For 2022

New Irs Life Expectancy Tables Mean Lower Rmds In 2022 Thinkadvisor

Rmd Table Rules Requirements By Account Type